Our world underwent a massive change in the last decade helping us transition from landlines to smartphones, physical cash to a digital wallet, and the list goes on. Cryptocurrency was the biggest wonder of the 21st century which offered an internet-based medium of exchange to people for conducting financial transactions. In stark contrast to financial exchange entered into with fiat currencies, cryptocurrency brought in a higher degree of transparency, decentralization, and immutability. The best thing about cryptocurrency is that it is not regulated by any central authority and this makes it immune to any interference by the government or other financial bodies. Today we are going to take a look at some of the biggest players in the crypto sphere:

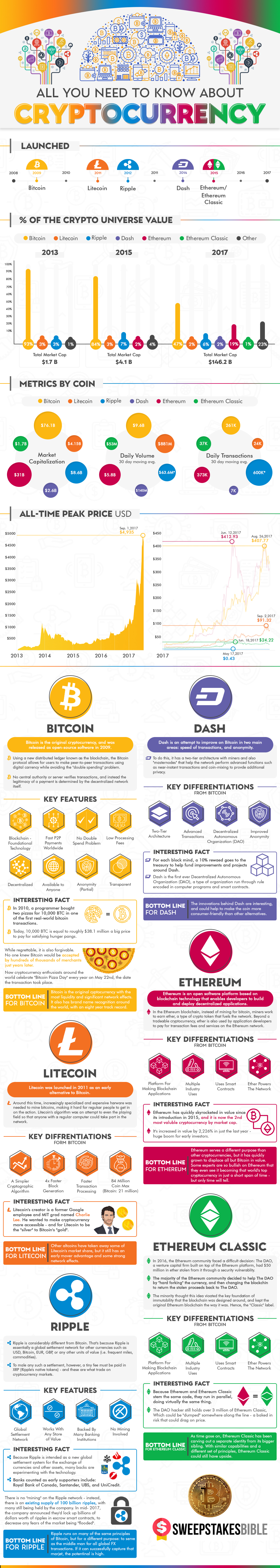

Bitcoin

Bitcoin is the foremost decentralized global currency fostering easy transactions around the globe weighing on a stable internet connection. The price of Bitcoin is determined by the forces of demand and supply. The first commercial transaction with bitcoin was entered into on 22nd May 2010 for buying two pizzas. Bitcoin was just over a year old and 10000 BTC was used for honoring the transaction whose present value is around tens of millions.

Brief History:

Bitcoin was invented in 2009 by an anonymous person by the name of Satoshi Nakamoto who wished to offer a completely decentralized electronic cash system with no central authority or server. Though no monetary value was generated by Bitcoin in its first two years of functioning, it slowly started garnering community support and this led to improvements in the original code.

Working:

Bitcoin is powered by an underlying blockchain technology which can be thought of to be a digital ledger. Blockchain represents all the Bitcoin transactions which are divided into blocks. The blockchain nodes remain scattered throughout the world and can be created by anyone to preserve the same. This digital currency is owned through a private key which guarantees safe storage. Bitcoin miners enter the picture once a transaction is created and signed using a private key before being broadcast to the network. The miners verify and validate the transactions which are then put into blocks and broadcasted to the blockchain. Miners can earn either block rewards or transaction fees for validating the transactions. All the transactions undertaken using bitcoin are fully anonymous and not controlled by any bank, financial institution, or jurisdiction.

Features:

- There is an upper limit on the number of Bitcoins that can be minted. This ceiling of 21 million keeps it buffered from inflation, unlike fiat currencies.

- Users won’t be taxed on making a purchase using bitcoin as all the transactions are completely anonymous.

- Transaction processing time is faster than traditional currencies as it doesn’t have the typical authorization requirements.

- Bitcoin is best suited for making international payments given the lack of involvement from the government and intermediary.

Interesting Facts:

- There are more than 10000 Bitcoin ATMs worldwide allowing users to connect with a Bitcoin exchange for buying and selling this crypto.

- Machines running Bitcoin’s software face a requirement of 0.25% of the global electricity consumption.

Litecoin

Litecoin is a peer-to-peer payment system and cryptocurrency which was built on Bitcoin’s success. Since its inception, the price of Litecoin has increased tremendously and even outperformed Bitcoin several years following its launch.

Brief History:

Litecoin was invented by Charlie Lee in the year 2011 as a substitute for Bitcoin. The Litecoin developers aimed at creating a cheaper and quicker payments network than Bitcoin and this was attained by altering the various elements of Bitcoin’s open-source code. This foremost Bitcoin fork made the block generation time four times faster while the fees became a quarter of its price.

Working:

The Litecoin blockchain processes transactions and adds new blocks by implementing the proof-of-work consensus mechanism. Litecoin miners bank on computing power to solve complex mathematical problems. The miner who first solves a problem can add the next block to the chain by validating the next set of transactions. They are rewarded newly minted Litecoins for their efforts. The Litecoin digital currency is transmitted to the recipient from the sender after it has been processed on the blockchain. Litecoin developers changed the mining algorithm to Scrypt for reducing cost and improving transaction times compared to Bitcoin. Since then, the mining process has become more energy-efficient and memory intensive for being mined by people using standard computing equipment while sitting in the comfort of their homes.

Features:

- Quick block time of Litecoin helps users to transact money instantly without the involvement of a third party.

- As all the attempts at manipulation get readily detected by the miners, the chances of fraud become negligible.

- Cheap transfer fees allow users to transmit money around the globe with a few clicks. Receiving Litecoin is not fee intensive making it an easy choice for vendors.

- SegWit implementation in the Litecoin cryptocurrency network enhances the network scalability by storing signatures necessary for the transaction in a different block on the chain.

Interesting Facts:

- It has become possible to directly swap Litecoin for Verticoin since 2017. These transactions occur using the on-chain atomic swap technology on the respective blockchain and don’t require the involvement of a third-party exchange.

- Litecoin gets more easily affected by external factors such as the economies of scale compared to any other cryptocurrency. The price of Litecoin received a heavy blow in March 2020 courtesy of the financial pressure created by Covid-19.

Ripple

Ripple is a networking company that developed the digital asset referred to as XRP for fostering global payments. As an enterprise blockchain-based solution, Ripple (XRP) has been allowing users to engage in cross-border money transfers across a variety of global payment networks. Since its launch, Ripple has evolved into the third-largest digital currency in terms of market capitalization.

Brief History:

The origin of value token, popularly known as XRP can be traced to 2012 when the Ripple Transaction Protocol was developed by Ripple Labs.

Working:

Bitcoin and similar blockchain cryptocurrencies attain a consensus using the Proof-of-Consensus or Proof-of-Work protocol. But this is not the case with Ripple (XRP) which banks on a consensus protocol designed in 2004 by Ryan Fugger. Known popularly as Ripple Protocol Consensus Algorithm (RCPA), this technology is aimed at solving the ‘double-spend’ problem without banking on labor-intensive mechanisms like the Proof-of-Work. A distributed agreement protocol is used by XRP’s ledger for determining which transactions are seen first by a node in the network. If the agreement is not canceled and attains the nod of the majority, the consensus remains valid.

Features:

- XRP payments are cleared within four seconds whereas BTC transactions require more than an hour and ETH payments need around two minutes for successful completion.

- Investors can bank on RippleNet to convert fiat to fiat with a $0.00001 transaction commission.

- It becomes possible for users to facilitate trading between owners of specific assets by issuing their goods-specific tokens.

- XRP is more centralized than Bitcoin as 60% of the 100 billion XRP is held by Ripple Labs.

Interesting Facts:

- Ripple boasts of an impressive list of payment providers and banks such as Bank of America, American Express, Royal Bank of Scotland, Japan’s SBI Holdings, Barclays, etc. who use its network.

- Unlike its peer cryptos, XRP is not minable as the total count of Ripple has already been created with 45% currently in circulation.

Dash

The Dash cryptocurrency runs on an open-source blockchain allowing everyone to access the new updates and propose protocol changes provided the same receive a green signal from the majority of the nodes.

Brief History:

In the January of 2014, an American blockchain developer Evan Duffield forked Litecoin to create XCoin. Next XCoin was rebranded as Darkcoin and in March 2015 Darkcoin was rebranded as Dash.

Working:

Dash uses a combination of Proof-of-Stake and Proof-of-Work mechanisms wherein the former determines the mining reward based on the number of coins owned by a user rather than the computational power. The source code of Dash is similar to Bitcoin with the difference lying in the type of nodes. While all nodes are equal on Bitcoin, Dash has special nodes termed as Masternodes. Having a holding of 1000 Dash in your wallet can help you become a masternode following which special features can be enjoyed. The masternodes also enjoy voting rights when it comes to making network improvements. Masternodes have to spend a lot of money to run every service within the network. The reward process of masternodes is similar to masternodes and 45% of the mined DASH is offered to the miner whenever 1 DASH is mined. The Masternodes receive another 45% as their reward for operating the Dash blockchain and the remaining 10% is used for improving the Dash network.

Features:

- Users can enjoy complete anonymity with Dash as funds can be sent privately by mixing it with other transactions using the PrivateSend feature. As a result, identifying the origin and destination of any specific transaction becomes pretty difficult.

- The InstantSend feature allows honoring currency transactions between users in just 1.5 seconds. Although availing this service has a higher processing fee, it allows instant transaction confirmations and is best suited for ‘point of sale’ transactions.

- The native funding system and governance of Dash allow people to apply for the funding of their Dash-related projects.

- Cryptocurrencies can be transmitted without relying on the services of middlemen like the government or bank and this leads to lower transaction fees.

Interesting Facts:

- Dash was designed with an upper ceiling of 18 million on its supply and is expected to be fully dug up within 2300.

- Dash operates on a self-funding and self-governing model wherein the network funds itself for bringing about more improvements to Dash technology.

Ethereum

Ether is the digital currency owned by Ethereum, an open-source decentralized blockchain system. The network of computers on Ethereum uses blockchain technology and a unique coding language to generate value tokens known as Ether. You can think of the entire network to be a programmable blockchain allowing users to create smart contracts using a peer-to-peer protocol.

Brief History:

Ethereum was created in late 2013 by Vitalik Buterin, a Russian programmer. He made a formal announcement of Ethereum at The North American Bitcoin Conference in Miami, the USA in January 2014. The main motive behind the launch of Ethereum was to create codes and execute smart contracts and DApps without any human interaction.

Working:

Operations of the Ethereum network are overlooked by the Ethereum Virtual Machine that enables developers to run their favored code and execute scripts. Periodic upgrades are made to the Ethereum protocol for improving its security and architecture. Users can both build and run different types of transactions and smart control courtesy of its universal value. Ether offers an incentive to miners and keeps the Ethereum blockchain secure. There is an upper cap on the yearly supply of Ether at 18 million and a new Ethereum block is mined every 12-14 seconds. A reward of 5 Ether is given to the computer behind its mining.

Features:

- Codes written on the Ethereum blockchain cannot be tampered, altered, or hacked.

- Smart contracts in the Ethereum blockchain facilitate the exchange of valuable assets. On execution, the contract cannot be altered and any transaction done on top of that gets permanently registered.

- Anonymous parties on the network conduct the verification process for the smart contracts without the requirement of any third party.

- All currency or asset transfer is done in a trustworthy and transparent manner wherein the identities of both the parties stay secure on the Ethereum network.

Interesting Facts:

- Wei to Ether is what Satoshi is to Bitcoin or cent is to US dollar. In other words, it is the smallest denomination of Ether and has been named after crypto expert Wei Dai.

- Mining Bitcoin blocks require around 10 minutes on average while Ethereum requires between 10 to 20 seconds so that more transactions can be added to the Ethereum blockchain in less time.

Ethereum Classic

Ethereum Classic is the native token of the blockchain which is known by the same name. Decentralized applications can be created and smart contracts can be executed on the Ethereum Classic blockchain which owes its look and feel to the unwavering loyalty of the developers to the main principles of blockchain.

Brief History:

Russian programmer Vitalik Buterin founded Ethereum in July 2015 for turning Bitcoin into a smart contract platform. The community faced a tremendous crisis in the form of the DAO hack less than a year later and this led to the birth of Ethereum Classic. The DAO aimed at creating a crowdfunding platform. However, the presence of a critical bug in its program code led to hacking and massive drainage of funds.

Working:

You can hardly find any difference between Ethereum and Ethereum Classic from the technical viewpoint. Ethereum Classic banks on almost similar tools for building Dapps like peer popular platforms. Ethereum Dapps can be easily moved to Ethereum Classic as its virtual machine is EVM compatible. Ethereum Classic uses the Proof of Work consensus algorithm which requires physical mining devices. The average block time is 14 seconds and the transaction capacity is 15 TPS which is double that of Bitcoin.

Features:

- The USP of Ethereum Classic lies in its unchanging stability towards protecting the freedom of choice of users and complete preservation of decentralization. This fact was violated by Ethereum developers for the whims of investors and self-interest. However, it got restored in the Classic version.

- Liquidity is considered as the most important factor when it comes to trading cryptocurrency on open exchanges and the Ethereum Classic coin is well past its predecessor Ethereum when it comes to sales from the initial day of its existence.

- Users are sent system-generated emails and telegram notifications on the creation of new blocks.

- A high level of security allows the network to function steadily without any delay or failure despite numerous hacking attempts.

Interesting Facts:

- Ethereum Classic has a well-established infrastructure with its data center located in America, Europe, and Asia for staying buffered from DDOS attacks.

- There is no need to convert Ethereum Classic to BTC making it easy to exchange to fiat money.

In simple terms, cryptocurrencies are limited entries in a database that cannot be altered without fulfilling certain conditions. Unconfirmed crypto transactions can be easily forged and the miner must validate their legality before spreading them in the network.